First Impressions:

The shoes come with a storage bag and allen key for adjusting the toe and heel pieces. The shoes themselves are about 50g's lighter than the outgoing Ergo 3 model even though they seem to be almost entirely constructed of patent leather as opposed to the leather / nylon mesh mix of the ergo 3's.

Aside from the no nylon mesh the other noticeable feature is the way Sidi dispensed with the forefoot velcro strap and the ratchet type instep strap in favour of twin Tecno 3 twist type ratchet dials. The soles are the same and have the usual functionality in that the toe and heel bumpers are replaceable. Additionally the toe bumper has a mini vent that can be opened for extra ventilation where and when required, though be warned this requires a phillips head screw driver . . . not something you want to be doing on the side of the road with a multi-tool in my view.

Sidi has continued with their adjustable heel piece that allows you to tighten the shoes heel enclosure to help with lifting. I've played with this enclosure on both my previous pairs of Sidi shoes, but never really felt any great benefit or hinderance from the piece. Given everyone's feet are different I guess it's better to have the adjustability than not have it.

The shoe tongue has a wire mesh panel allowing greater ventilation to the upper foot. You can see it in the below photo criss-crossed by the wire enclosure straps.

I have to wonder how this might go in the rain, so if you know it's going to be wet I suggest you might want to put some overshoes in your back pocket just in case.

The shoes come with the usual Sidi cleat adhesive which has one side that seems to be some type of very fine sand paper. These are supposed to be affixed to your cleat to prevent movement between the sole and the cleat. I never use them. I ride Look Keo cleats and have never had a problem with them while wearing Sidi shoes. I use a torque wrench and adjust the cleat screws to 4.5NM which is mid point in the recommended range detailed in the very comprehensive cleat guide booklet.

The Fit:

I got my shoes in a size 45.5 and if you already had the previous Ergo3's or even the 2's I saw and felt no noticeable change in the shape or length of the shoe. Buy with confidence in your current Sidi size. I have a wide foot, but I didn't buy the specifically wide version which is available in some geographies.

At first look I was somewhat intimidated by the all-leather look of the Wires. I just felt that they might not give easily to the shape of my foot as standard running shoe nylon mesh is want to do. I put some heavy cedar shoe trees in them overnight hoping they would stretch out a bit before riding in them.

I slipped into them at 5:30am the following morning looking to do a hilly ride along Sydney's eastern beaches. Normally when I wear new running or cycling shoes I pick a slightly thicker pair of socks, but given that the ambient temperature in the dawn light was already 21ºC I went with the very thin Rapha Pro Team Socks giving me little room for error.

I like the ratchet type instep strap on the Ergo 3's and 2's because you're able to tighten or loosen the enclosure while on the move without putting yourself at too much risk. As a skier I like to start with tight boots and slacken or tighten dependent on conditions or aggression I'm skiing with. I do the same with cycling shoes and often on a long ride I like to loosen things off a bit to allow some extra circulation. The micro adjustment available on the wires through the dial system's side triggers does not in my view allow precise and safe on the go adjustment. Having said that I slipped into the shoes without any great problems and immediately got to some comfortable settings without too much trouble.

Hopping on the bike I had no problems with engagement and felt no immediate rubbing as I headed up my street to the first descend of the morning.

Riding:

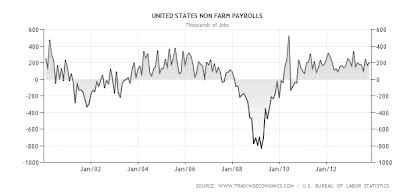

The course I chose maybe only 30km in length, but it encompasses about 500m of climbing on suburban streets:

There are lots of short sharp climbs requiring the rider to constantly change position and rhythm on the bike. The shoes felt cosseting without being tight and I was surprised I didn't have to get off the bike and adjust any of my settings during the ride. For most of the ride I even forgot that I was wearing new shoes and only gave them a second thought when I happened to look down at the the road during a flat sprint.

At the end of the course I usually get breakfast at my local cafe. Cooling down I didn't feel the need to open the enclosures for comfort, so all good.

After the ride I purposely examined my feet for any signs of specific chaffing or pinching and could detect none. The thin socks new shoe combo worked. Obviously the fact that I had no sizing issues helped a lot, but the multi-faceted adjustable nature of the shoes gives even the fussiest wearer the scope to get comfortable.

Care:

My previous leather and mesh combo Sidis always gave me cleaning problems. The mesh always picked up oil and road dust and no matter what I tried I couldn't get them completely clean. I should mention I throw my running shoes in the washing machine every now and then. This always works for me. I never tried it with cycling shoes, more out of fears for the health of my front loader washing machine, than for the shoes themselves.

As the shoes are a synthetic patent leather I like to use a latex and rubber cleaner that was recommended to me by a Swiss friend when I lived in Geneva. A quick wipe and then a spray and wipe with the cleaner keeps the upper moist and removes any remaining dirt.

Conclusion:

With only 2 rides and 60km's under my feet it's hard to be too emphatic, but my feeling is that these are likely to be as good as anything on the market. There are 5 standard colours and Sidi issues various team or special editions periodically. The normal retail price for these in Australia is about $500, but I suggest if you are confident of sizing, shop around. Lastly a warning for those with 1/2 size sensitive feet. I know in Australia and the UK it can be difficult to find the half sizes above size 45; they're like gold . . . buy them if you can because they don't seem to last.

Highly recommended.

Ciao!