You know sometimes you don't need the latest kit to love riding a bike. My friend rides a beautiful hand painted Colnago Master XL. I know it's hard pushing the extra kg's of the steel frame, but it's the price you pay for beauty.

|

| Colnago Master in Rabo Bank Colours |

Wow Mike, that seems really odd. Makes me wonder if the stem was oversized in production for some reason. Ideally, have your local shop contact our distributors down there and they should be able to warranty it sue to an oversize clamping area cause that definitely should not be happening! I haven’t heard of that happening before so makes me think there was a minor issue with the clamping surface… But, as I said have your shop contact our distributors down there about a possible warranty on that stem.

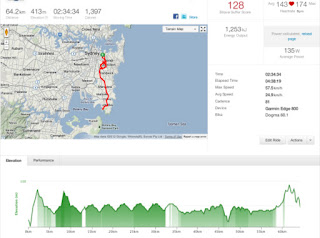

I'm not upset with that response, but I am concerned about production glitches in general, especially when it comes from a Dutch company. My Dutch friends tended over the years to be super precise in things they do, so I wasn't expecting this. Anyhow I'm going to swap the Stem to another brand on Thursday so I can ride the bike in the Cycle Spring Classic Ride here in Sydney on Sunday. 50k's and I believe I get to ride across a car free lane on the Sydney Harbor Bridge!. The downside is you start at 7am . . . that kills Saturday night.

I'm slightly bemused by the mortgage markets in Australia and elsewhere around the world. In a speech Bill Dudley, president of the New York Fed, said “concentration of mortgage origination volumes at a few key financial institutions” meant that banks were not passing on low interest rates to borrowers. Really Bill? Well this is what happens when you designate a few banks as being to big to fail. Additionally if you drive rates to zero do you really think with Basel III looming that bankers want to take the risk for such small absolute returns especially as their cost of raising equity is still relatively higher?

In Australia we have 4 big banks and virtually no one else and I can tell you they do not pass along the full rate cuts offered by the RBA to mortgage holders because there is no competition for loans yielding these type of rates. And thats in a country with the best AAA yields available.

The world's economies are not normal and unless governments claw back some power from Central Banks via proper execution of their mandates then we will all continue to suffer.

Of course in the dreamworld that is silicon valley the fast failing Yahoo is now offering a package worth up to USD 60m to Henrique de Castro of Google. I have no idea who he is or what he does, but if this is Marissa Mayer's master plan to resurrect Yahoo then I'm pretty skeptical. I'm not so skeptical why Newscorp paid Rebekah Brooks GBP 7mil as she walked out the door . . . . moving right along. . .

Once upon a time in Japanese equities battery makers were very hot. Government subsidies for hybrid cars and alike meant that the sky was always blue. I never followed A123 Systems, but the US government gave them a direct injection of USD 249mil . . . and now they're filing for bankruptcy.

|

| A123 Systems . . . going, going . . .! |

Ciao!

No comments:

Post a Comment