If a tree falls in a forest and no one is around to hear it, does it make a sound? At the moment we have reached a point in the markets where no one is around to hear, maybe they wouldn't want to hear if they were? I saw a chart this morning on ZeroHedge that showed that yesterday's volume was some 3 std devs below the long term trend.

If you doubt these numbers just go to some of the raw data on the NYSE's own website. The market seems now to be on perma holiday ahead of the Jackson Hole meeting at the end of August when the expectations are that Bernanke will bring down some magic tablets from upon high and rescue us from the current malaise.

Carl Weinberg (founder High Frequency Economics) was being interviewed today on Bloomberg's economics show. Dr Weinberg's usual deadpan presentation always seems to rattle host Michael McKee, so I thought it was admirable that the interview started by posing 2 questions: a) Is there anything today to be optimistic about? and b) Does anyone care?

In terms of caring I think volumes demonstrate that there is no one around to care. I know I make jokes about the Euro-crats being in St Tropez etc., but in reality most of the northern hemisphere is out permanently in August. As we know Merkel got back from 2 weeks vacation yesterday and I bet a lot of her first 4 hours in the office were spent trying to track down staffers. If she looked at the VIX index since she left she might have thought everything was fine as it was hitting a five year low yesterday:

Certainly 2 weeks after Draghi dropped his verbal "save the Euro at all costs bomb" the markets have consistently rallied. No one has answered the fundamental questions of how Draghi will achieve his goal and what is the associated cost. Will the ESM be allowed to buy bonds? If they buy bonds will the ECB buy at the short end in order to shift the curve in it's entirety?

Crucially I believe that these questions may need to be answered today. A €3.2 billion bond matures on August 20 and the Greek

Public Debt Management Agency said they will conduct an auction for 13-week T-bills today. If the auction goes well then they will avoid having to

seek emergency funding on top of the bailout loans it receives from the

Europe and International Monetary Fund. My guess is the auction will have to go through, even if it means that the ECB indirectly intervenes by way of modification to it's collateral requirement rules. The Euro-crats just won't want to deal with this problem via their smart phones while enjoying a long lunch by the Med.

But back to Dr Weinberg who surprisingly said that he thought that the GDP number out of Japan was actually better than expected. IP & retail sales for the month each showed a 1.25% contraction. Where does the GDP positive come from? The figure includes a large investment projection for fixed assets non-residential (Tsunami rebuilding?). The current number lacks credibility and looks likely to be revised down when real fixed investments get printed. Look for downward revisions over the coming months.

What surprised me was Dr Weinbergs optimism on China. He made some reasonable points, though they were predicated on a reversal in GDP back to trend growth of just under 10% by year end. The key corollary to this rosy scenario is food inflation. He likened it to household gasoline expenditure in the US (it makes up 6% of the basket), but it's more crucial in China where food accounts for 30% of the consumer basket. A slowdown in internal retail consumption could be a sign that Chinese are saving for food price inflation which we know from the recent surge in corn prices because of the US drought is likely to hit them hard.

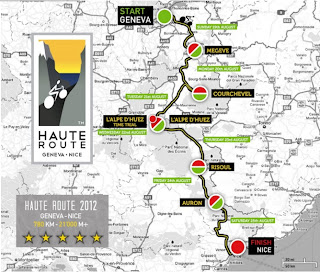

All this talk has me thinking about vacations. I'm not sure when and if I'll be able to afford my next vacation, but as dreams are free I took time off today to check out the offerings for Europe next summer. My first stop was Haute Route which offers several multi-day options for organised events. I'd like to think I could do the Geneva - Nice event which covers 7 stages:

• Stage 1: Sunday 19th August: Geneva - Megève (120km, 2700m+)

• Stage 2: Monday 20th August: Megève - Courchevel (105km, 2700 m+)

• Stage 3: Tuesday 21st August: Courchevel - Alpe d'Huez (138km, 4700 m+)

• Stage 4: Wednesday 22nd August: Alpe d'Huez Time Trial (15km, 1100 m+)

• Stage 5: Thursday 23rd August: Alpe d'Huez - Risoul (136km, 3700 m+)

• Stage 6: Friday 24th August: Risoul - Auron (98km, 3200 m+)

• Stage 7: Saturday 25th August: Auron - Nice (175km, 2900 m+)

That's a lot of climbing for a rider like me and I think I'd have to strip 5kgs to make the finish. If you consider the Courchevel - Alpe d'Huez section alone is 4700m of climbing in a day, which would be just over 2x what I've ever been able to do in the past you can guess how much training I'd need to do. One day . . .

Ciao!

No comments:

Post a Comment